Early August this year, a new record for gaming collectibles was set with a WATA graded copy of Super Mario Bros. being sold for $2 million USD!

Since early 2020, billions of dollars have flooded the private assets’ market causing drastic rise in asset prices. From Pokemon cards to original video games such as Super Mario, the recent cultural and societal shift into private assets has reached fever pitch levels. Money rushing into these tangible assets is looking for protection from inflation and a shot at even more appreciation within the next decade.

However, with the meteoric rise in these asset prices, the interest in counterfeiting such assets and defrauding buyers rose too. Demand for third party grading services has never been stronger. For example, WATA (a third party grading video gaming authentication service) has a backlog of several months. The need to prove authenticity is crucial for any asset - including the aforementioned. A prime example of this is the recent issue of Pokémon games being faked whilst the SNES celebrates its 30 year anniversary.

NFT is another investment vehicle that has popped on the scene. NFT’s are popular and have tremendous investment potential. However, they appear to address digital assets only. We see a huge opportunity in marrying NFTs and physical assets. Introducing - nftize™! Using our nftize™ concept implemented in an easy-to-use APP, we are able to take an existing asset (digital or physical) , and create an irreplicable digital representation of it via blockchain. For this article we are using Symbol from NEM, but in theory any blockchain that supports NFTs can be used.

What is nftize™?

The word nftize™ is a pending Trademark owned by IoDLT. To nftize™ an asset is to issue a non-fungible token (NFT) for that asset and store it on a digital ledger, called a blockchain. The nftized asset certifies the asset’s authenticity, condition, and provenance. It may also certify other criteria unique to that asset: A financial security’s terms and conditions for instance. In future articles, we will detail how the nftize™ protocol/app can be relevant to other asset classes.

An nftized asset allows for the best of both worlds, as the asset can be owned and traded digitally, as well as enjoying the advantages of being a tangible asset that can be physically delivered or stored in an audited storage.

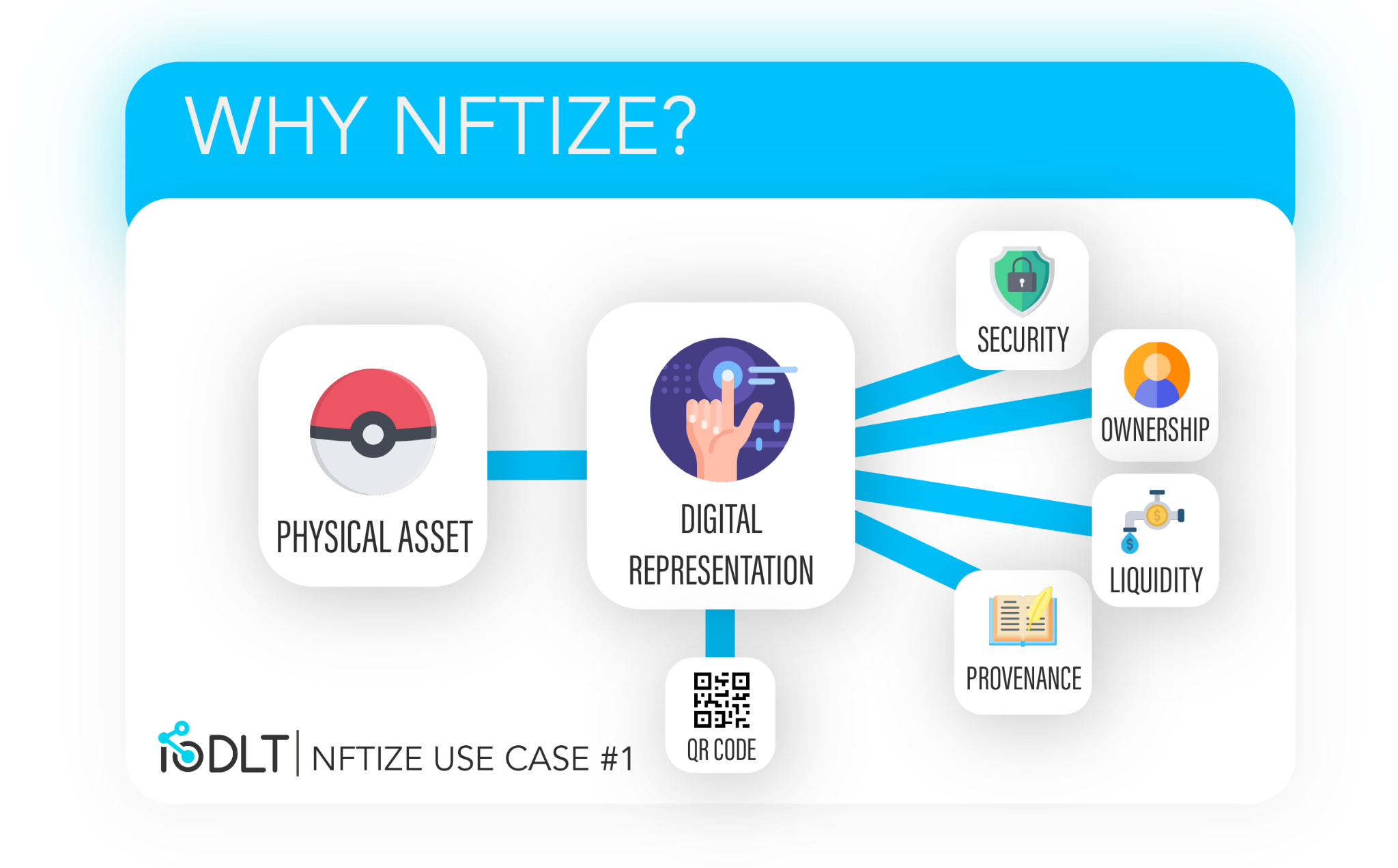

Why nftize™?

NFTizing an asset provides a lot of perks - security, proof of ownership, liquidity / transferability, and provence of an item.

This begs the question - why nftize™ a physical asset in the first place? What is the value in creating a digital representation of an already existing asset?

Liquidity is the simple answer. To nftize™ a physical asset makes it more liquid in the marketplace. It increases more confidence as the asset is authenticated, provenanced, and digitally tokenized. The digital tokenization opens it up to the whole world as a marketplace.Furthermore, the confidence translates to trust. As the item’s authenticity, condition, and provenance is recorded on the blockchain, market participants across the globe can trade nftized assets with ease. All of this can be represented via a simple QR code or NFC tag, making it incredibly easy to scan and verify quickly.

Blockchain’s inherent immutability and transparency lends itself to trust in marketplace of assets and allows for easy price discovery giving way to a lot more liquidity.

How nftize™ Works using Symbol

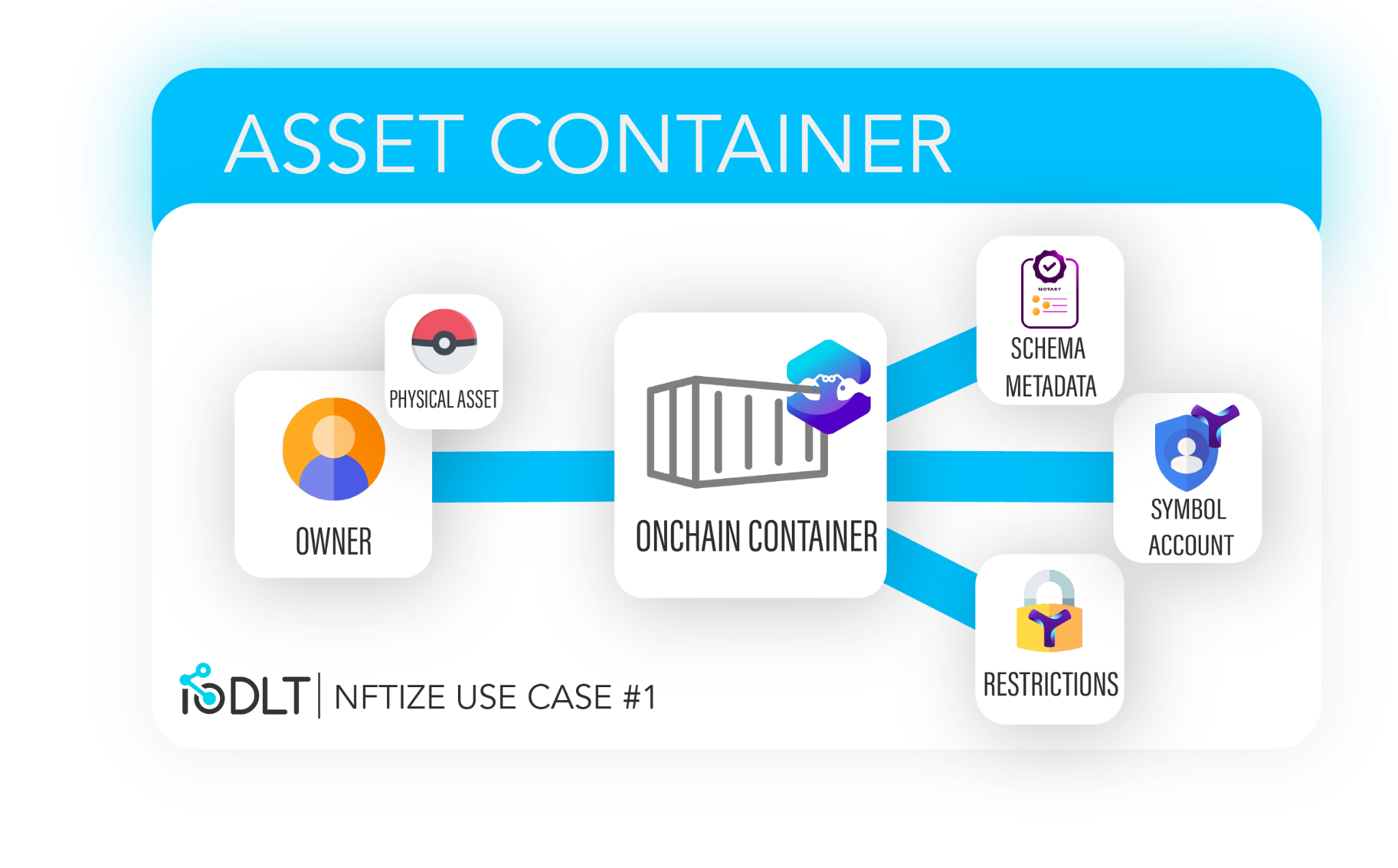

The way nftize™ works is quite simple in theory and implementation. Since NFTs are supposed to be unique and unable to be replicated, there are several routes to go about this with Symbol. For this use case, we will use the Accounts feature.

Essentially, since each account is a unique cryptographic key, we can use each account as a sort of container to represent the asset and all of its information. All asset information is recorded to the account using Symbol’s various features, such as Account Metadata. Along with metadata, a schema, or template of the asset, is recorded with it to ensure the data’s integrity is kept.

Using this method, we can specify not only what to record, but how it should be recorded (and if it should be edited in the future). We could’ve used Symbol’s Mosaic functionality, but using Accounts allows for the NFT to even hold a balance - useful in the case of signifying contract terms (such as even tokenizing a piece of real estate and keeping funds in escrow) in more complex use cases.

Registering Assets on using the nftize™ APP- Certified Mario Kart 64 CASE STUDY #1

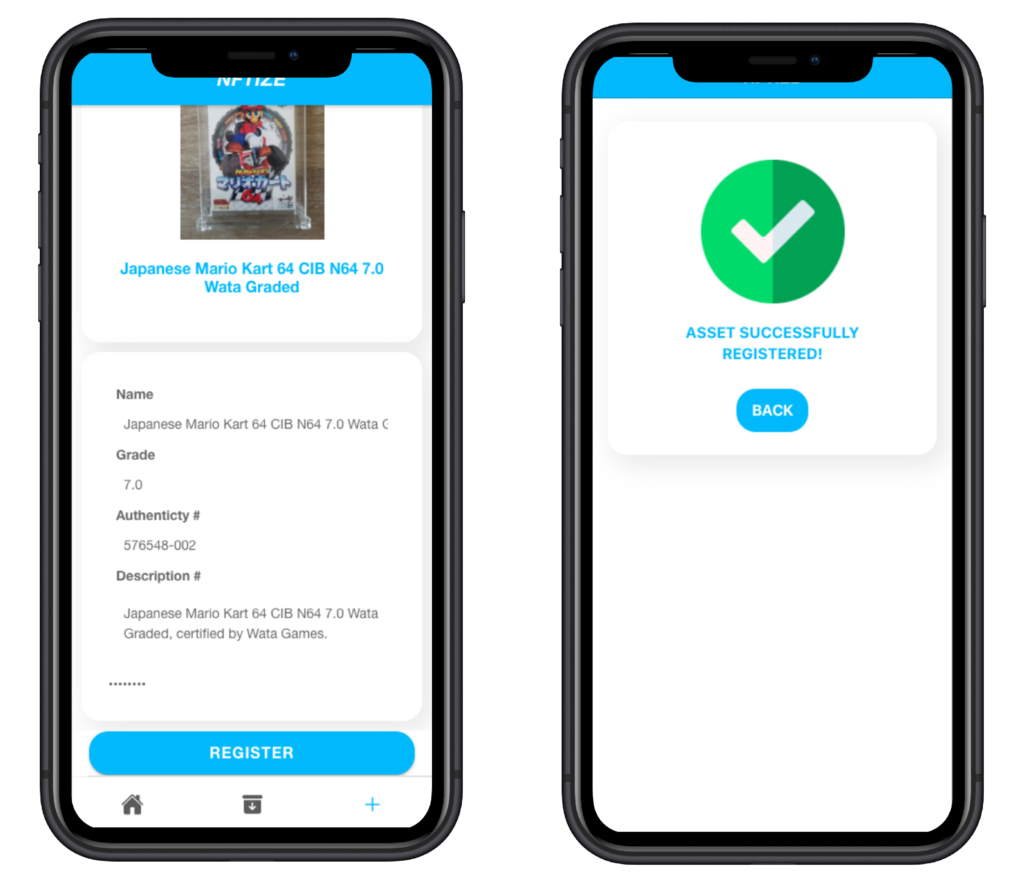

We’ve managed to get our hands on a WATA graded Japanese version of Mario Kart 64 for the N64 console. What’s different about this copy, is that it has been graded and verified by WataGames, a known company that specializes in grading sealed games and ensuring their protection. Part of guaranteeing the authenticity of a physical asset is having it be verified and graded by some established and known authority (such as a Third Party Grader TPG), then recording this on the chain as well. In the future, these TPG’s can have a presence on-chain and sign off cryptographically on these assets to solidify trust.

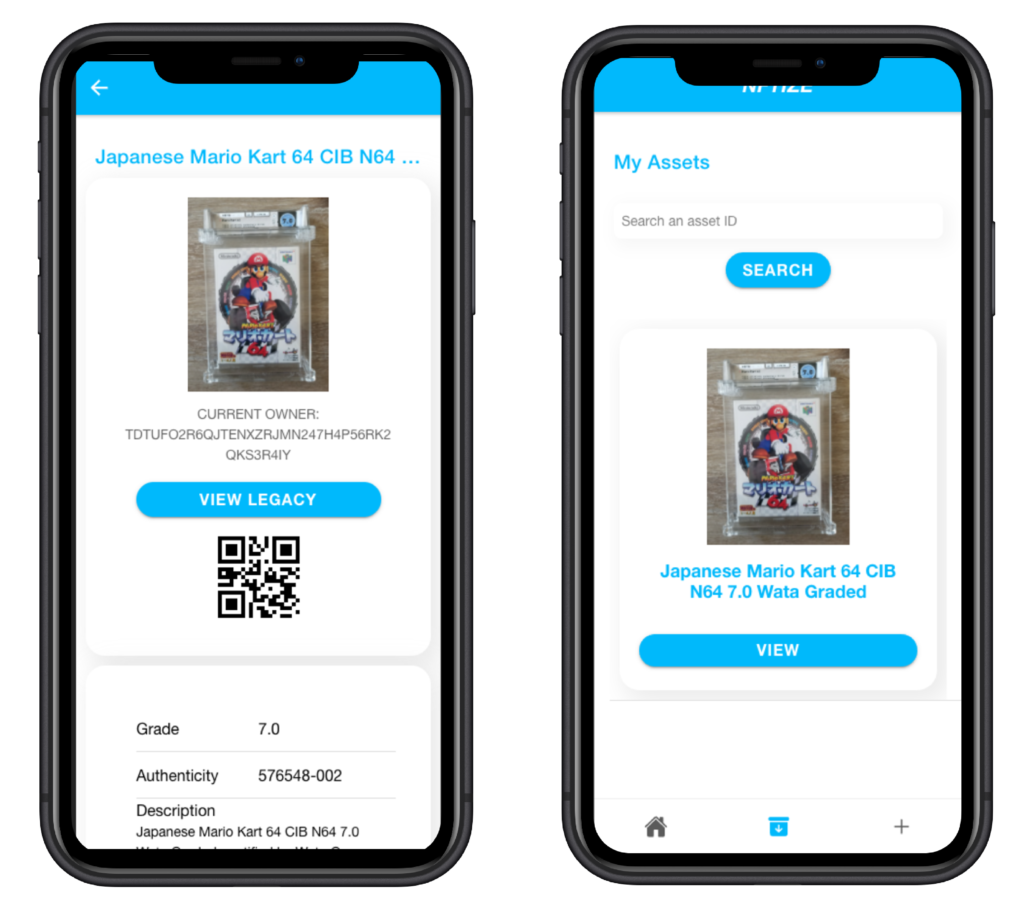

At IoDLT we already have a solid PoC app in the works - here, we showcase how to nftize™ the graded Mario Kart 64 piece. The app is built in Ionic and uses the Typescript Symbol SDK to communicate with a test network to register the asset on the blockchain.

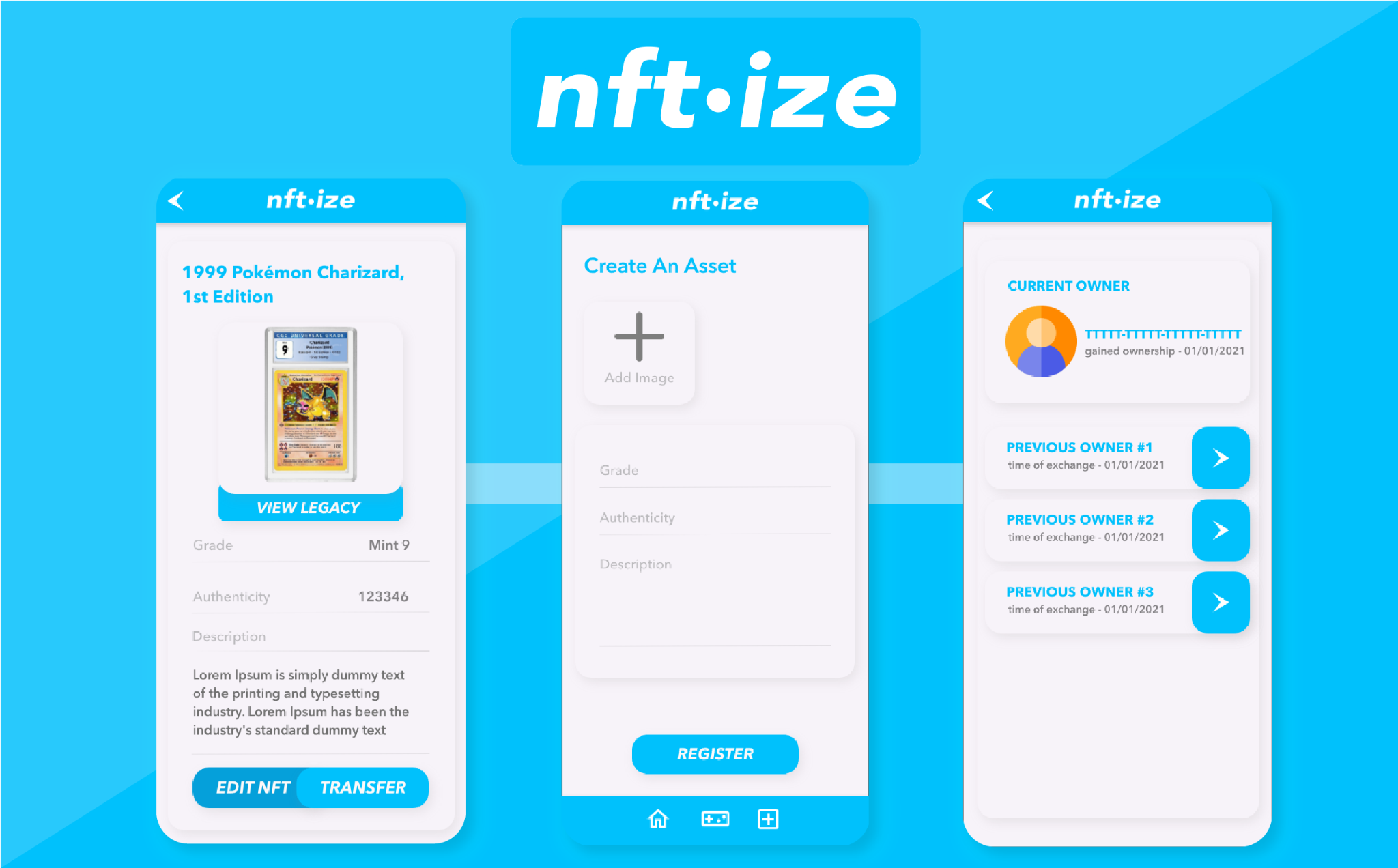

The first step is to log in like any normal app. For now, we just have a local sign in using an encrypted keypair just like a normal crypto wallet. Only here, instead of coins, we’re managing real physical assets:

After that, you can start the asset registration process. For now, we have a few specific parameters, however this can expand to as many parameters as we want for any type of asset:

After that, the asset is now viewable, owned, and tradable. The ownership can be transferred via Symbol Multisig - however, we may change this to a token model later on as it’s more befitting for NFTs.

And just like that, that asset can now be owned, transferred, and have proven authenticity using nftize™ and Symbol. In the future, the buyer of an nftized asset can either take physical delivery after paying for shipping charges or store it in an audited secure storage.

Conclusion

nftize™ is a easy to use protocol to document the authenticity, condition, and provenance of physical and non-physical assets. nftized items can then be easily traded across borders between trustless entities. Such ease will increase liquidity and trust in the marketplace leading arguably to higher prices in diverse asset clases. We believe to nftize™assets is the way of the future with very diverse applications as will be demonstrated in the future.